Create Your Version of This Document

What Is a Voided Check?

A voided check refers to a check that has the word “void” written across the front of it. This is to ensure that the check cannot be used to make any unauthorized payments.

People typically use permanent blue or black ink to write “void” on the blank check so that the word cannot be easily erased.

Why Do You Need to Use Voided Checks?

Although electronic banking has become increasingly popular, people still void a check to submit their banking details for direct deposits and automatic bill payments.

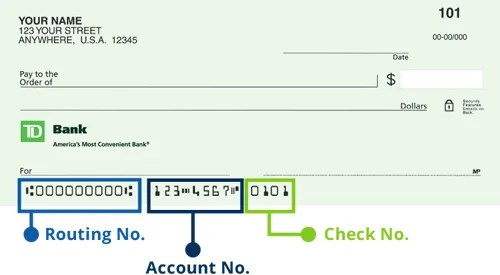

This is because checks contain the following important information:

- The name of your bank or credit union union

- Your bank account number

- A routing number, which is a code used to identify which bank you use

This information gives employers, contractors and financial institutions everything they need to set up an electronic link to an account for deposits or withdrawals.

When Do You Need a Voided Check?

Now that you have a better understanding of what voided checks are, let’s take a closer look at when they would be used.

To Schedule Direct Deposits

Some employers and payroll departments still use a voided check form to set up direct deposits for their employees’ paychecks.

The information provided on voided checks also allows the employer to ensure that their employees’ bank account details are accurate before they make any payments.

To Set Up Automatic Payments

Many people use voided checks to schedule automatic electronic payments for their own personal use or if they run a business.

For example, if your business pays contractors electronically, submitting a voided check may be required to authorize automatic payments into their bank accounts.

Similarly, if you want to set up an automatic mortgage, rent or car loan payments, voided checks may be necessary.

To Set Up Automatic Payments

From writing the wrong amount to spelling a payee’s name incorrectly, it’s easy to make errors when filling out a blank check.

In the event that the check ends up in the wrong hands, voiding it ensures that the person cannot alter it or make the payment out to themselves.

What Is the Difference Between a Voided and Canceled Check?

It’s easy to get confused between a voided and canceled check. Let’s take a look at what the difference is between these two concepts.

As we’ve seen, a voided check is used to submit banking information to contractors, vendors and financial institutions.

If there are any mistakes on the check, the person can access the original and void it.However, a canceled check refers to a check that has been successfully processed and the money has been deducted from the person’s checking account.They are considered to be “canceled” because the bank has processed the transaction. This means that the money can’t be accessed or be reversed.

Are There Any Alternatives to a Voided Check?

Some people don’t have access to a check register anymore, whereas others don’t feel comfortable sacrificing a check to be voided.

In these cases, there are a few alternatives to voiding a check:

- A direct deposit authorization form: These are documents that allow third parties to send money directly into an individual’s bank account.

- A voided counter check: This is a blank check that people receive when they first open a bank account. These are often used while personalized checks are being printed.

- A photocopy of a check or deposit slip that contains your bank and deposit account details.

Where Do You Get Voided Checks?

There are a few different ways to access voided checks. One of the ways to do this is to request a copy of a voided check from your bank.

Many banks have a designated department that standardizes the voiding check procedure to reduce the chance of error or fraud.However, this can take some time because the bank would need to order and print the voided check for you.

You can also void a check yourself. All you need to do is write “void” in well-spaced letters across one of your checks.It’s important to ensure that the word covers the entire check without interfering with your banking details at the bottom.

Another option is to simply write “void” in the date, payee, amount section and signature line.

Although this seems like a convenient option, it can be time consuming and open up the possibility of human error.If the check ends up in the wrong hands and it isn’t properly voided, it could lead to costly mistakes.

You can also use web-based generators like Form Pros to download a voided check easily and safely.This is a simple and efficient process that eliminates the waiting time for voided checks and the chance of error.

Why Use Our Voided Check Generator?

At Form Pros, we have developed an efficient and convenient solution to creating voided checks online.Our software will help you create voided checks in a matter of minutes. We also offer a subscription plan so that you can create unlimited voided checks at a lower cost.

The best part of all? Form Pros does not require the installation of additional software, which will save you even more time and money.

Generate Voided Check Now

Voided Check FAQs

- Where can I find my bank routing number and account number?

The routing number, a nine-digit sequence, can be found in the lower-left corner of your check. The account number is the set of numbers, located just to the right of the routing number. The shorter set of numbers on the far right side represents your check number. If you don't have access to a physical check, you should be able to retrieve this information by logging in to your bank's website and selecting your account.

- What are the risks of voided checks?

The main risk involves the exposure of your banking details. Always ensure you are giving the voided check to a reputable and trustworthy entity. Avoid sharing it publicly or online.

- Can I reuse a voided check for multiple setups?

Yes, the same voided check can be used to set up multiple direct deposits or automatic payments, as the account and routing numbers don't change.

- What should I do with a voided check?

Keep a record of it in your check register and store the voided check securely until you've confirmed that the direct deposit or automatic payment setup is successful. Then, it can be shredded.

- Can I void a check after sending It?

Once a check is sent, you cannot void it. If you need to stop a check you've already sent, you will have to contact your bank to issue a stop payment order, which may come with a fee.

- Is it safe to give a voided check?

Yes, it is generally safe as it can't be used to withdraw money. However, it does contain sensitive information, so ensure you're providing it to a trusted party.

- What if I don't have checks?

If you don't have checks, you can ask your bank for a "pre-printed" voided check, a letter with your account information, or use an alternative method like a bank deposit slip with the account information handwritten on it. As a great alternative you can utilize the formpros.com voided check generator which allows you to easily create a voided check online.

- How do I void a check?

Write "VOID" in large letters across the front of the check. Ensure it's readable but doesn't cover the account and routing numbers. It's also a good practice to record the voided check in your check register.

- Can I provide a digital copy of a voided check?

It depends on the company's policy. Some may accept a digital copy, while others might require a physical check. It's best to ask the specific company for their requirements.

- Is it safe to email a voided check?

While emailing a voided check is common, it's important to ensure the email is sent securely due to the sensitive information on the check. Use encrypted email if possible.

- What should I avoid when voiding a check?

Answer: Avoid obscuring the account and routing numbers. Also, don't use a check that has any other writing or signatures on it, other than the word "VOID".

- What to do if a voided check is misused?

If you suspect misuse of a voided check, contact your bank immediately to take appropriate action, which might include monitoring your account for fraudulent activity or closing the account.

- Can I use a voided check for proof of bank account ownership?

Yes, a voided check is often used as proof of account ownership since it displays your name, account number, and bank routing number.

- What alternatives can I use if I can't provide a voided check?

Alternatives include a bank deposit slip with your account information, a bank statement, or a direct deposit authorization form provided by your bank.